[ad_1]

There isn’t any denying that Nvidia (NASDAQ: NVDA) is on a roll. The chip designer has knocked each earnings report out of the park since OpenAI unveiled the ChatGPT synthetic intelligence (AI) software, powered by the corporate’s AI accelerator chips.

Trailing gross sales are up by 126% in simply 5 quarters. Free money stream soared 610% greater over the identical interval, and Nvidia’s inventory worth greater than quadrupled.

Golf claps and finger snaps aplenty, please. Nvidia has made many buyers some huge cash on this AI increase, together with yours really.

However this is not the best time to purchase extra Nvidia shares. The inventory is buying and selling at extremely lofty valuation ratios as the corporate’s buyers wager it would proceed to dominate the AI {hardware} area for years to return. Since I am not so certain about that, I lately took some Nvidia earnings off the desk to reinvest in some lower-priced however equally thrilling progress shares.

You might not need to promote Nvidia inventory right this moment. In any case, I would not advocate shopping for extra of it proper now.

Because of Nvidia’s inflated share worth, I recommend you keep away from shopping for this inventory till it cools down a bit. However if you happen to insist on shopping for AI shares proper now, take a better have a look at digital design software program veteran Autodesk (NASDAQ: ADSK) and semiconductor pioneer Intel (NASDAQ: INTC).

Autodesk’s AI-driven technique

Autodesk is leaning into the AI alternative. The corporate is already a pacesetter in generative AI instruments, notably within the discipline of professional-quality 3D photographs.

“We will already generate 3D representations from photographs 10 occasions sooner and with vastly greater high quality than at the moment accessible 3D AI,” CEO Andrew Anagnost stated in February’s fourth-quarter earnings report.

To construct on this industry-leading experience, the corporate is rebuilding its core merchandise round a shared, AI-driven design engine. The grasp plan is all about product lifecycle administration, the place a computer-aided design (CAD) can transfer from one workforce to a different inside every consumer’s working construction with out operating into crimson tape and pace bumps. On the similar time, software program enhancements and new options created to serve one goal market can simply discover use circumstances throughout different clients and venture varieties.

Once more, Autodesk depends on high-quality machine studying and generative AI instruments to ship these deliberate efficiencies.

These are early days in a “multiyear course of,” and the improve path hasn’t been clean up to now. Gross sales are rising however not skyrocketing. Free money stream is down in current quarters — and Autodesk has delayed the submitting of year-end monetary paperwork, as auditors discovered inconsistencies within the fourth-quarter’s cash-flow calculations.

Because of this, buyers took a step again from the late paperwork challenge, and Autodesk’s inventory is down 17% within the final month. It trades at 8.6x trailing gross sales and 36x free money stream. That is a cut price subsequent to Nvidia, with respective ratios of 33.8 and 76, respectively.

Sure, Autodesk is rising slower than Nvidia proper now, and I do not love the doubtless flawed monetary reporting. Nonetheless, I am downright excited concerning the firm’s long-term enterprise prospects because the modular, AI-powered software program platform evolves.

I purchased my first Autodesk shares two years in the past, because the {industry} veteran’s inventory seemed undervalued from a long-term perspective. After just a few wild swings, the inventory worth is again the place it was in April 2022, however trailing gross sales are up by 20% and the AI catalyst ought to add extra worth over time.

Intel’s strategic shift towards AI and chipmaking providers

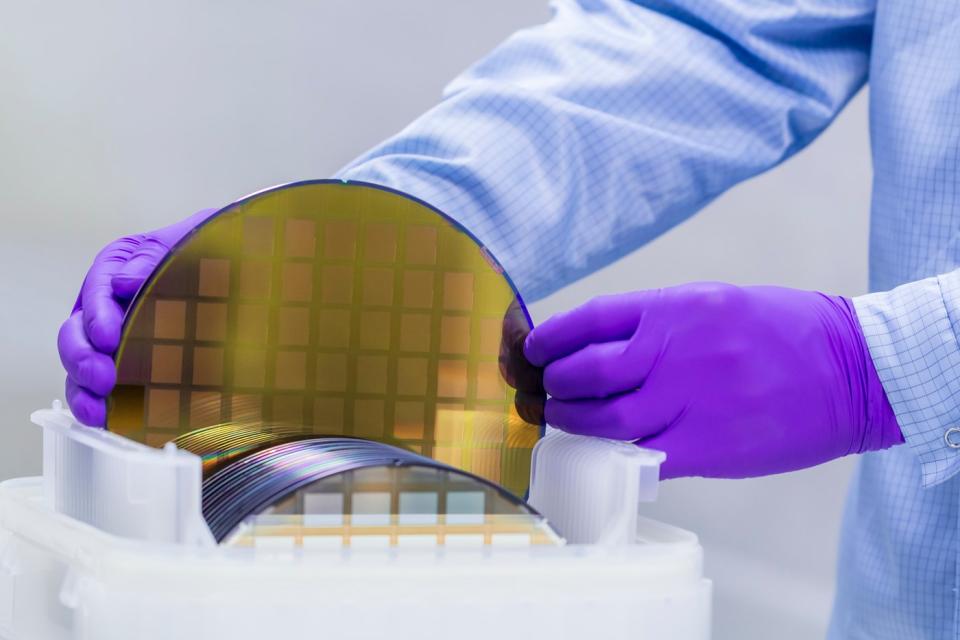

Intel’s enterprise mannequin can also be remodeling. The corporate remains to be the main identify in PC and server processors, however Superior Micro Gadgets is gaining floor in each markets. Alternatively, Intel faucets into the AI increase from a number of angles, and the lately launched processor manufacturing enterprise doubled its income in 2023.

This ain’t your grandfather’s Chipzilla anymore. Some buyers aren’t comfy with Intel’s shifting technique, anticipating the corporate to defend its conventional processor enterprise in any respect prices. However I’d a lot slightly personal inventory in an organization keen to vary with the occasions than watch an outdated titan sticking to its outdated weapons. Butch Cassidy and the Sundance Child does not have a cheerful ending, y’know?

The Intel Gaudi 2 might not be the quickest AI accelerator on the earth, however AI system builders usually do not search for most efficiency per chip. Intel delivers the place it counts.

“Our Gaudi 2 AI accelerators proceed to show worth efficiency management in comparison with the most well-liked GPUs,” CEO Pat Gelsinger stated in January’s earnings name. “In a current weblog revealed by Databricks, Gaudi 2 was proven to obviously ship one of the best coaching and inference efficiency per greenback based mostly on public cloud pricing.”

Furthermore, the next-generation Gaudi 3 accelerator will launch later this yr with quadruple the processing energy and double the networking pace of the present chip.

The Xeon line of server processors stands entrance and middle within the AI programs market, too, because the supercomputers that practice the beefiest massive language fashions (LLMs) use these chips to manage every accelerator module’s data-crunching actions. 5 of the ten quickest supercomputers on the earth right this moment depend on hundreds of Intel Xeon processors. The most important one, Argonne Nationwide Laboratory’s Aurora system, even makes use of Intel GPUs as an alternative of Nvidia’s or AMD’s. These chip gross sales add up in a rush when every processor prices not less than $11,600.

The brand new and improved Intel is a severe AI competitor, with necessary aspect gigs in conventional processor gross sales and semiconductor manufacturing. Intel is at the moment consuming money on account of pricey upgrades and new building of chipmaking amenities. However the inventory trades at simply 2.7x gross sales, greater than 30% beneath its 52-week highs.

Traders searching for a promising AI technique and a versatile working mannequin may discover Intel an intriguing selection, particularly at its present valuation. And that is why I might a lot slightly purchase Intel and Autodesk shares than double down on my Nvidia place proper now.

Must you make investments $1,000 in Intel proper now?

Before you purchase inventory in Intel, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Intel wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $488,186!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 22, 2024

Anders Bylund has positions in Autodesk, Intel, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Autodesk, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Overlook Nvidia: 2 Synthetic Intelligence (AI) Shares to Purchase As a substitute was initially revealed by The Motley Idiot

[ad_2]

Supply hyperlink