[ad_1]

Lots of the firms benefiting from the speedy adoption of synthetic intelligence (AI) have seen their share costs rise impressively because the starting of 2022, making it troublesome for traders to search out worthy AI shares buying and selling at cheap or comparatively engaging valuations.

Tough, however not not possible.

There are a minimum of two strong alternatives proper now for traders trying to get their palms on potential AI winners that have not grow to be prohibitively costly from a valuation standpoint — Micron Know-how (NASDAQ: MU) and Oracle (NYSE: ORCL). Let’s discover out a bit extra about these two AI shares and why they may make good additions to your funding portfolio in April.

1. Micron Know-how

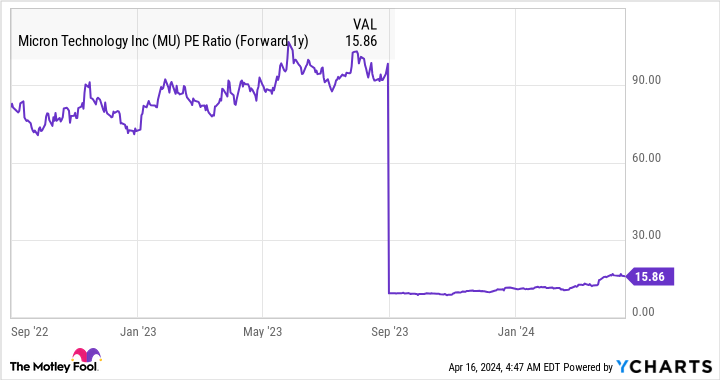

Micron Know-how inventory’s year-to-date features stand at 42%, which explains why it’s now buying and selling at 7.3 instances gross sales as in comparison with 5.8 instances gross sales on the finish of 2023. Nevertheless, Micron’s gross sales a number of is in keeping with the U.S. know-how sector’s common price-to-sales ratio of seven.1. Additionally it is value noting that Micron’s ahead price-to-earnings ratio has plunged to a a lot decrease degree than the tech sector’s common of 44.3 due to the corporate’s latest progress acceleration.

So, traders can nonetheless purchase Micron at an inexpensive valuation. They need to take into account capitalizing on this chance, because the chipmaker may develop at a faster-than-expected tempo due to favorable reminiscence pricing developments. Taiwanese publication DigiTimes expects Micron to lift the costs of its dynamic random-access reminiscence (DRAM) and NAND flash reminiscence by greater than 25% within the second quarter. And DRAM costs already rose by 10% to fifteen% within the first quarter.

The stronger reminiscence pricing setting is the results of a spike in demand, primarily resulting from a mix of the expansion in AI use and reminiscence producers’ technique of holding their output in test. For example, Micron administration identified on its March earnings convention name that it expects its spending on wafer and fabrication gear to drop in its fiscal 2024 (which started Sept. 1).

Furthermore, reminiscence producers’ output was impacted by the latest earthquake in Taiwan, and stories point out that they’re weighing additional worth hikes to make up for any manufacturing shortfalls. Throw in the truth that semiconductor firms reminiscent of Nvidia, Intel, and Superior Micro Units have been trying to get their palms on extra high-bandwidth reminiscence (HBM) to make extra highly effective AI chips, the demand for Micron’s choices ought to proceed to stay scorching.

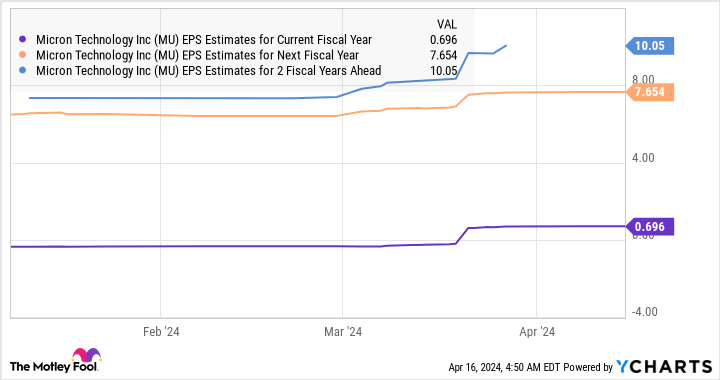

Because it seems, HBM costs shot up by a whopping 500% final yr. The development is anticipated to proceed in 2024 with the HBM market’s income anticipated to leap by a minimum of 150% to greater than $14 billion, in response to Yole Group. Not surprisingly, analysts have been elevating Micron’s earnings per share (EPS) predictions primarily based on latest developments.

If the inventory does hit the consensus EPS forecast of $10.05 in a few fiscal years, and if on the level it trades at 27 instances ahead earnings, in keeping with the Nasdaq-100‘s ahead earnings a number of (utilizing the index as a proxy for tech shares), its inventory worth would have greater than doubled to $270 per share. That is a strong argument for getting Micron inventory this month.

2. Oracle

Oracle’s AI credentials received an enormous enhance after the corporate launched its fiscal 2024 third-quarter outcomes final month. Buyers purchased the inventory hand over fist following the report, which provided clear proof that AI is ready to drive important progress within the enterprise.

Shares of Oracle are up virtually 15% this yr, and the great half is that the inventory is at present buying and selling at 32 instances trailing earnings. Its ahead earnings a number of of 19 is much more engaging. It might be a good suggestion to purchase Oracle at this valuation contemplating the potential for accelerating earnings progress.

Analysts forecast that its backside line will develop at an annualized price of 11% for the following 5 years, up from 9% up to now 5. Nevertheless, the corporate’s bettering income pipeline signifies that it may outpace analysts’ expectations. Oracle’s remaining efficiency obligations (RPO) rose by 29% yr over yr to $80 billion final quarter. RPO is the entire worth of future contracts that an organization has to meet, and Oracle’s elevated at a sooner price than its 7% improve in quarterly income to $13.3 billion.

Even higher, Oracle’s RPO is considerably larger than its trailing-12-month income of $52.5 billion. AI is enjoying a central position in boosting its income pipeline. Administration identified that the numerous bounce in RPO was pushed by the “giant new cloud infrastructure contracts” that it signed through the quarter.

Extra importantly, the corporate believes that it’ll proceed to win extra new enterprise “as a result of the demand for our Gen2 AI infrastructure considerably exceeds provide.” Additionally, it expects its cloud infrastructure enterprise to “stay in a hypergrowth part” due to its aggressive efforts to construct new knowledge facilities and increase its present ones to fulfill AI-related demand.

It’s value noting that the demand for cloud-based AI providers is forecast to extend at a surprising annualized price of near 40% by the tip of the last decade. Oracle has began capitalizing on this chance already and appears set to ship strong progress in the long term. In mild of all that, shopping for shares of Oracle proper now may become a wise long-term transfer.

Must you make investments $1,000 in Micron Know-how proper now?

Before you purchase inventory in Micron Know-how, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Micron Know-how wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $514,887!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 15, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Nvidia, and Oracle. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

2 Prime Synthetic Intelligence (AI) Shares to Purchase in April was initially revealed by The Motley Idiot

[ad_2]

Supply hyperlink